The Basic Principles Of Paul B Insurance Medicare Insurance Program Huntington

Wiki Article

The Definitive Guide for Paul B Insurance Medicare Agency Huntington

Table of ContentsEverything about Paul B Insurance Medicare Insurance Program HuntingtonLittle Known Facts About Paul B Insurance Medicare Advantage Plans Huntington.10 Easy Facts About Paul B Insurance Medicare Insurance Program Huntington DescribedThe smart Trick of Paul B Insurance Medicare Health Advantage Huntington That Nobody is Talking AboutThe 8-Minute Rule for Paul B Insurance Insurance Agent For Medicare HuntingtonThe 30-Second Trick For Paul B Insurance Medicare Insurance Program Huntington

For example, for some steps, in 2022, if the ranking on that particular action was less than the previous year, the scores changed back to the 2021 worth to hold strategies safe. An extra 2 percent of enrollees are in plans that were not ranked since they are in a plan that is too brand-new or has also reduced registration to get a score.

The celebrity ratings presented in the number above are what recipients saw when they picked a Medicare prepare for 2023 and also are various than what is utilized to figure out reward payments. In current years, Med, PAC has increased worries regarding the celebrity ranking system and quality benefit program, including that celebrity scores are reported at the contract as opposed to the plan degree, and also might not be a beneficial indicator of quality for beneficiaries since they include a lot of actions.

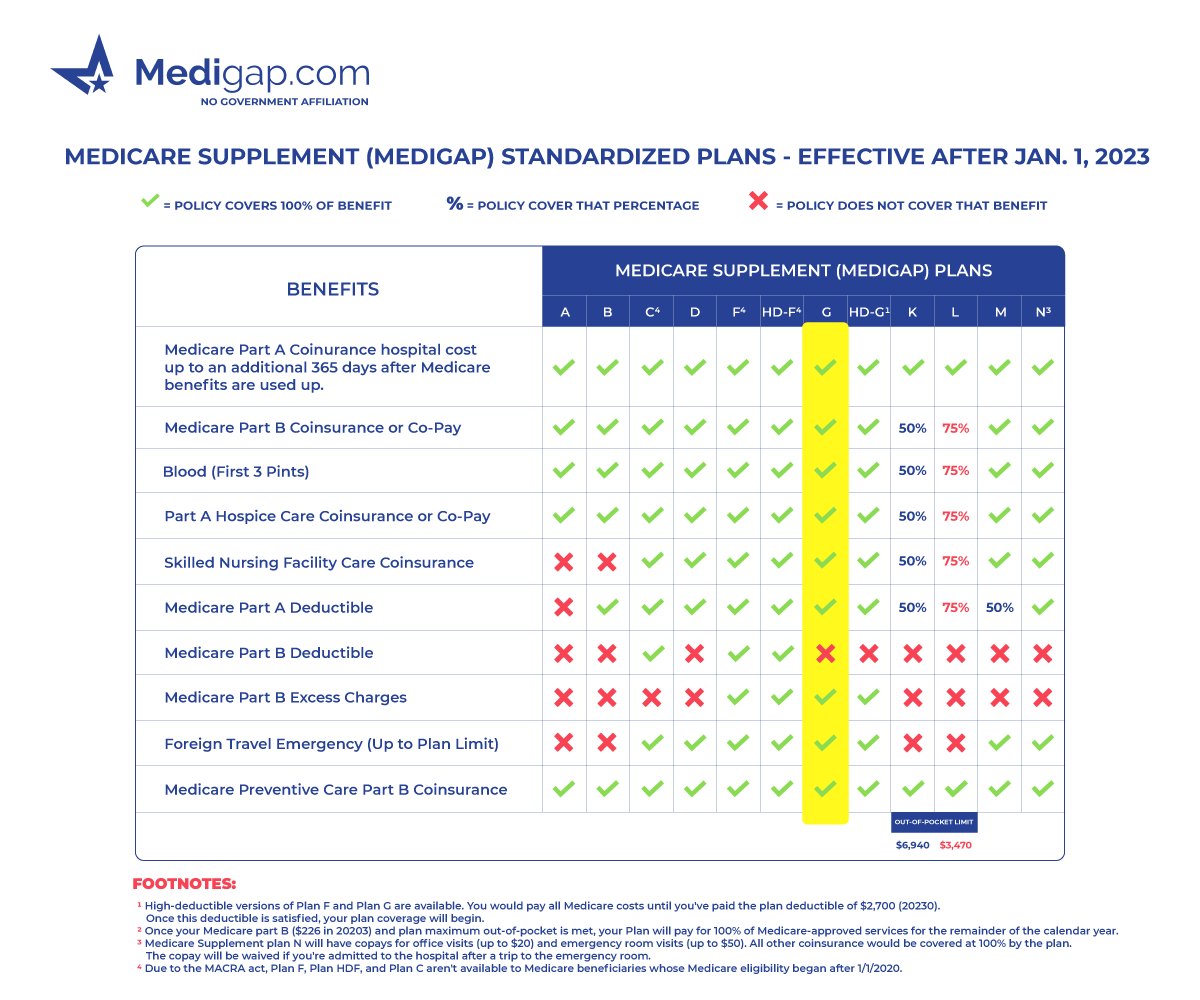

Choose a Medicare Supplement plan (Medigap) to cover copayments, coinsurance, deductibles, and various other expenses not covered by Medicare.

Paul B Insurance Medicare Supplement Agent Huntington Can Be Fun For Everyone

An HMO might need you to live or function in its solution area to be qualified for protection. HMOs often give integrated care and also concentrate on prevention as well as health. A sort of strategy where you pay less if you make use of doctors, medical facilities, and also various other health and wellness treatment carriers that come from the plan's network.A kind of health insurance where you pay less if you use providers in the strategy's network. You can make use of physicians, medical facilities, and also suppliers beyond the network without a reference for an added expense.

Having a typical source of treatment has actually been located to boost quality and lower unneeded care. Most of people age 65 and older reported having an usual carrier or place where they receive care, with somewhat higher rates among individuals in Medicare Advantage prepares, people with diabetes mellitus, as well as people with high requirements (see Appendix).

Top Guidelines Of Paul B Insurance Medicare Agency Huntington

There were not statistically substantial distinctions in the share of older adults in Medicare Advantage plans reporting that they would certainly constantly or commonly get a response regarding a clinical problem the very same day they called their usual source of treatment contrasted to those in traditional Medicare (see Appendix). A larger share of older adults in Medicare Advantage plans had a wellness treatment specialist they might quickly get in touch with in between doctor sees for suggestions regarding their health problem (information disappointed).Evaluations by the Medicare Repayment Advisory Commission (Med, SPECIAL-INTEREST GROUP) have revealed that, usually, these plans have reduced medical loss proportions my policy (recommending higher earnings) than other sorts of Medicare Advantage plans. This shows that insurance firms' rate of interest in offering these populations will read this article likely proceed to grow. The searchings for also increases the essential to check out these plans independently from other Medicare Advantage plans in order to ensure high-quality, fair treatment.

Particularly, Medicare Advantage enrollees are most likely than those in traditional Medicare to have a treatment plan, to have someone who reviews their prescriptions, and to have a routine medical professional or area of care. By giving this extra help, Medicare Advantage plans are making it simpler for enrollees to get the assistance they require to handle their health treatment conditions.

The 4-Minute Rule for Paul B Insurance Medicare Agency Huntington

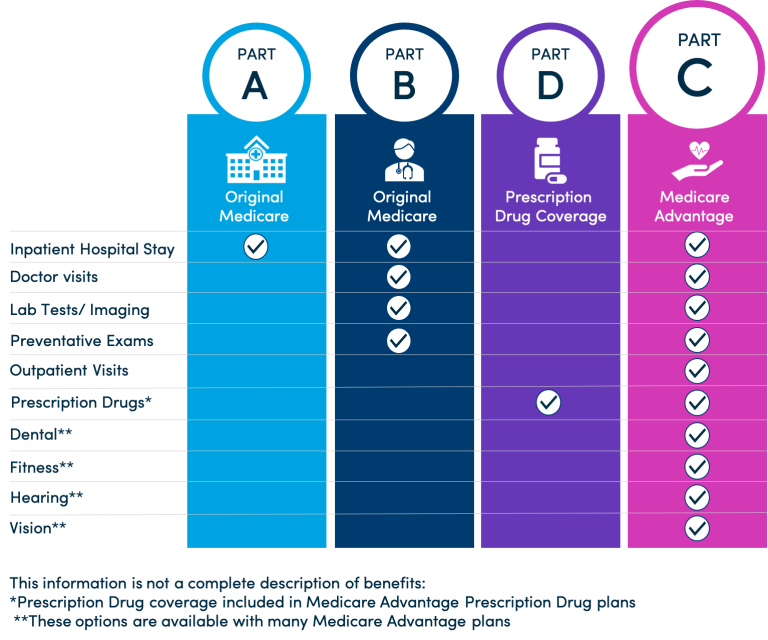

The study results also question about whether Medicare Advantage strategies are getting proper repayments. Medication, special-interest group estimates that strategies are paid 4 percent greater than it would certainly set you back to cover similar individuals in typical Medicare. On the one hand, Medicare Advantage plans appear to be giving solutions that help their enrollees handle their treatment, and also this included care monitoring could be of considerable value to both strategy enrollees and also the Medicare program.Part An and Part B were the very first parts of Medicare produced by the government. Additionally, a lot of people that do not have additional protection through a group plan (such as those supplied by companies) usually authorize up for Parts An and B at the very same time.

How Paul B Insurance Medicare Part D Huntington can Save You Time, Stress, and Money.

The amount of the costs differs amongst Medicare Advantage strategies. You might likewise have other out-of-pocket prices, consisting of copayments, coinsurance as well as deductibles. Medicare Benefit places a limitation on the quantity you pay for your protected general liability insurance coverage healthcare in a given year. This limit is called an out-of-pocket maximum. Initial Medicare does not have this feature.Some Medicare Advantage prepares need you to use their network of providers. As you explore your options, take into consideration whether you want to continue seeing your existing doctors when you make the switch to Medicare.

Excitement About Paul B Insurance Medicare Insurance Program Huntington

What Medicare Supplement plans cover: Medicare Supplement intends help take care of some out-of-pocket prices that Original Medicare does not cover, including copayments and also deductibles. That suggests Medicare Supplement plans are just readily available to individuals that are covered by Original Medicare. If you choose a Medicare Advantage plan, you're not qualified to buy a Medicare Supplement strategy.Report this wiki page